3 Essential Financial Reports for an eCommerce Business

When you enter the world of eCommerce, especially coming from a traditional business model, you should be quick to realize that it is a battle of information.

Your financial reports will paint the picture of the status of your business. In an industry built on the fast lane, accurate data recording will be the cornerstone of your business’s success. Without information, you miss signals for opportunity and growth, ending up with bad decisions.

The problem is, with the easy accessibility of data on the internet today, how do you stop yourself from wasting time due to information overload?

Simply stick with the basics.

Financial Data and its importance

Going into the arena unarmed with the right data is a suicide match, your competitors–or worse, your own bad choices–will easily knock you out of the game.

With good financial data, you can price your products accurately; you are able to know whether you are making money in your overall operations and in your individual products or projects. It helps you determine which products or services are worth keeping and letting go of. And if your product is losing, solid and consistent financial data will show you why and what you can do to change that.

The accuracy of your data will also help you build a budget and a forecast. All this information will help you make data-driven decisions for the growth of your business. Decisions such as hiring additional staff, borrowing money, or expanding your business.

As your business grows the number of reports recommended to you by financial experts will grow too. But, three (3) financial reports are universal for all businesses as the pillars of financial success.

1. Balance Sheet

A balance sheet is a statement that reports a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It shows your net worth. This information is more valuable when several periods are grouped to show the changes and trends in specific line items. For instance, you could compare the total amount of debt to the total equity to determine the debt-equity ratio which shows a company’s bad borrowing habits. It could mean your business is not self-sufficient and only staying afloat not from its own sales but from loans.

Another piece of information from the balance sheet is the inventory turnover which could indicate an excess of inventory. Determining the right amount of inventory will help increase cash inflow.

2. Profit and Loss

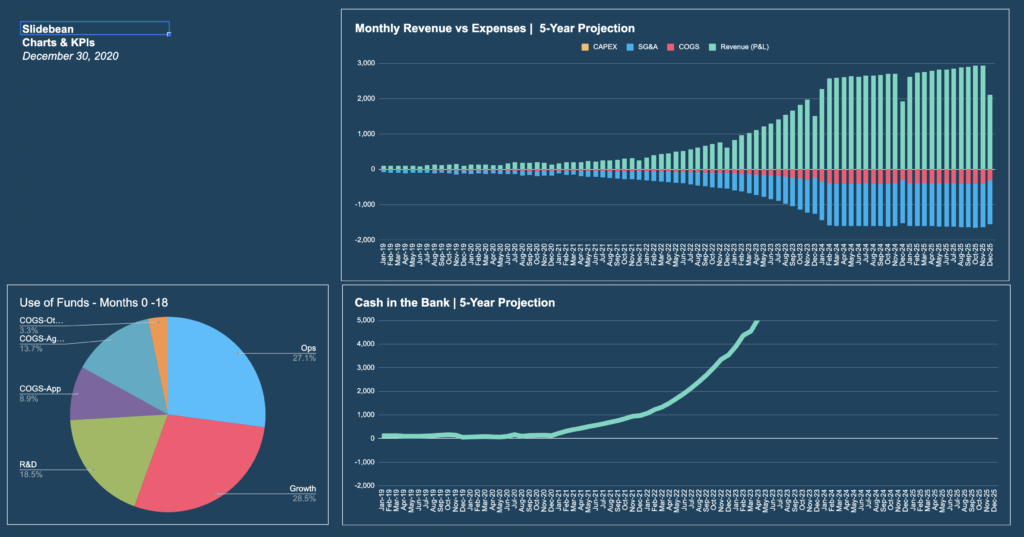

This financial report determines the performance of your business over a period of time. This will help with monitoring KPIs and predict future performance. When this information is grouped together, you will be able to see the trends in revenue and expense line items.

The gross profit will help you identify a good price point that a customer will accept and at the same time, one that can maintain the cost of goods that it requires. By grouping your revenue and expenses for a specific product, you can determine which of your products or services are worth keeping.

A comparison of the yearly statements will also be useful in Growth Analysis. To calculate this, subtract the previous period’s revenue from the current, then divide the number from the previous period’s revenue. If you earned $2M last year and you earned $2.5M this year, then your growth rate is 25 percent. This information will help you decide if you are ready to expand your business or take on a new product.

3. Cash Flow Forecast

We cannot stress enough the importance of this statement. This provides a beacon for your company, without which, don’t even dream of financial success. This statement will provide a glimpse into the future. It will help you predict cash surplus or shortage long before they are even made.

If you merely form estimates and don’t properly record this data, chances are you could end up costing your company more or losing an opportunity for growth. You think you could afford a purchase when in reality, you cannot; you could forego an opportunity because you think you don’t have cash when, in fact, you had extra. These are just instances when a forecast will come in handy.

It will save you from making a lot of careless and detrimental decisions. Nobody can predict the future, but wouldn’t it be nice to see even a minute into it? Wouldn’t that make all the difference?

Staying Consistent

Creating a reporting schedule will help you stay consistent in maintaining these reports and thus provide for better financial data. Information is only as good as it is timely. Especially in an industry that traffics data as fast as the internet. The use of the information provided by these reports will only be effective within a specific time frame. If you don’t work fast enough, your data could become irrelevant.

Take it one notch higher and establish a Review Schedule while you are at it. All of this seems to be overwhelming to do on your own. One way to lighten the load is to outsource your accounting. Have a trusted accountant process your raw data so you can focus on reviewing the reports. Here at Mehanna Advisors, we specialize in small business and eCommerce, drafting reports that fit the needs of this specific business model. If you want a well-crafted financial report, interpreted in a way that fits your eCommerce business, you’ve come to the right place.