![acastro_200311_3936_coronavirus_0002.0[1] acastro_200311_3936_coronavirus_0002.0[1]](https://www.mehannacpas.com/wp-content/uploads/elementor/thumbs/acastro_200311_3936_coronavirus_0002.01-ozvjnatirlil9oymlwj9mt63kkmcebn8yuepq6ckqq.jpg)

Tax Credits To Lessen Impact Of Coronavirus

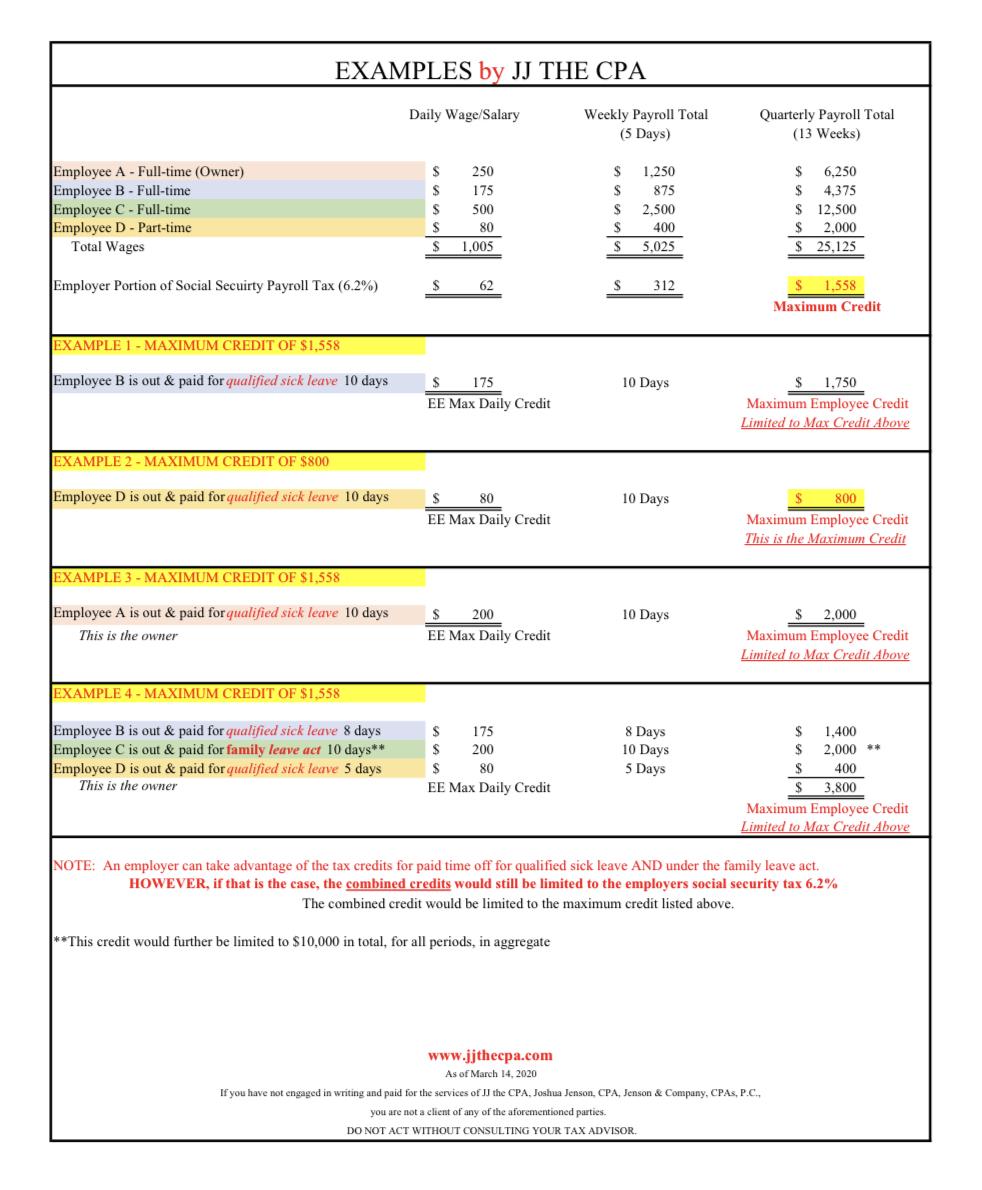

3 New Tax Credits Effective March 14, 2020, through December 31, 2020

$200 PER DAY, PER EMPLOYER FOR MAX 10 DAYS NOT TO EXCEED EMPLOYER’S SOCIAL SECURITY PAYROLL TAX (6.2%) PAID FOR ALL WAGES

FOR EMPLOYEES PAID QUALIFIED SICK LEAVE WAGES

• Experienced by the employer as an immediate payroll tax credit

o The payroll tax due to the U.S. Treasury is reduced immediately by the tax credit

o This does not reduce any state, local or unemployment taxes

o It is not retroactive

o An employer can elect not to take advantage of this by simply not doing it

o No special tax form is to be filed

o The credit is reported as a tax credit on the Form 941 filed quarterly

o If the credit exceeds the tax due, it is treated in the same manner as a refund due

o The credit reduces the tax deduction for the employer portion of payroll taxes

• Maximum of $200 per day, per employee

o Maximum of 10 days, per employee

Maximum of $2,000 per employee, in total

• If an employee makes $10/hr and routinely works 8 hours per day

o The max credit is $80/day and $800/employee

• If an employee makes $1,000/day

o The max credit is $200/day and $2,000/employee

o The language includes that the credit is per quarter, however…

Preceding quarters are taken into account to aggregate the maximum of 10 days

• Not to exceed the employer’s portion of the tax imposed under IRC section 3111(a)

o This tax is, in essence, the social security tax the employer pays on top of wages

o The tax is 6.2% of wages, only subject to the first $137,700* of annual wages per employee

On $20,000 of quarterly wages paid to all employees, assuming no one has exceeded*

• The employer’s social security payroll tax would be $1,240

• If the employer had one employee that qualified for the full $200/day, and that employee was paid for 10 days, the initial tax credit would be $2,000

• The initial tax credit of $2,000 would be limited to $1,240

• Paid for qualified sick leave wages under the Emergency Paid Sick Leave Act

o Applies to the owners, officers, highly compensated, full-time, part-time employees

o Has to have been actually paid wages for qualified sick leave

o Employee has to actually not have worked.

• CONTINUED: Paid for qualified sick leave wages under the Emergency Paid Sick Leave Act

o If an employee works for a partial day, it only covers the paid time not working

If an employee makes $10/hr and leaves work 2 hours early due to sickness

• The max credit for that employee is $20 for that day

• That day is used and only 9 days of credit for that employee are left

If an employee is part-time, the credit applies to the normally worked hours

• If an employee works 4 hours per day, per work, the 10 days applies

If any employee has un-routine hours, it is based on their average

o If any employee has accrued paid time off, there is no double benefit to the employer

o The employee experiences no extra pay or tax credit from the government

The wages paid to the employee are still taxable to the employee

The wages paid to the employee are still subject to all taxes

FOR THE SELF-EMPLOYED, IT IS A CREDIT AGAINST SELF-EMPLOYMENT TAXES

• For anyone self-employed and an employee, the maximum applies to 10 days and $200 maximum per day; per individual

• Self-employed would be typically for Schedule C filers and/or those receiving Form 1099-Misc “Non-Employee Compensation” (Distributions from an S-Corp or Partnership is not SE income)

• You have to be unable to work due to the provisions and have not worked.

• If you own a business and pay yourself wages, you are not considered self-employed for these purposes. If you don’t pay yourself wages, I think you can’t start now… Refer to the other provisions.

• If you are self-employed and have employees, the tax credit previously described applies to those wages you pay to your employees, and you experience the credit on your self-employment tax.

• This is experienced by reducing your individual estimated quarterly estimated tax payment.

• If you make individual estimated tax payments and do not have self-employment tax, you cannot reduce your estimated tax payments because you have no such tax to reduce.

FOR EMPLOYEES PAID FOR REQUIRED PAID FAMILY LEAVE

• The same above provisions apply when paying employees for qualified sick leave wages

• Paid wages by reason of the Emergency Family and Medical Leave Expansion Act

• A MAXIMUM tax credit of $10,000 for these wages

FOR EMPLOYERS WITH BOTH CIRCUMSTANCES

• The employer can use both tax credits, but can’t apply to the same employee, same day

• The employee must qualify separately for each provision, with the same limitations including limited to the employer’s social security tax (6.2% of wages)

DO NOT ACT WITHOUT CONSULTING YOUR TAX ADVISOR.

Credit to JJ The CPA for all the information above