Why You Should Start Forecasting Cash Flow?

Planning is the start of every venture. One way to plan for your business is to set up a cash flow forecast. Although it cannot predict every facet of the future, it will enable you to get a glimpse. It will help you keep your expectations in check. And in most ways, it will afford you peace of mind.

Business owners are usually profit-driven. They focus on future expectations of profit and loss without thoroughly understanding the small changes to sales, purchases, and other general business costs that will affect their bank balance.

In today’s new normal, as businesses try to maneuver socio-economic and political conflict, having a healthy cash flow is the number one priority. You will never know what disaster strikes next or whether any help will come after. In 2021, the need for a cash flow evaluation has become an imperative, inevitable necessity for the survival of any business, big and small.

What makes it important

The problem with profit-focused businesses is that they forget profit does not translate to money. On paper, you could be profitable, but your bank accounts would beg to differ. If you let your cash flow problems go unattended, they will create problems all over your business system.

Operating a business without a cash flow forecast is the same as operating a business, blind.

A forecast allows you to see the expected cash flow at a particular point in time. This single information will help create a better business model and allow you to make well-informed business decisions. What do we buy for inventory, when do we buy for inventory? Should we invest? Should we spend? Should we save? By plotting the cash flow movement, it will allow you to plan for the future.

There is no end to what a cash flow forecast can do for you. For you to make intelligent business decisions, a forecast is a prerequisite.

The most obvious example is inventory management. There have been many businesses finding themselves in a growth spurt, where they experience tremendous growth but are unprepared to match it. They suddenly find themselves with more customers than expected but are strapped for cash to buy the inventory to match the demand.

What happens? They miss an opportunity for expansion.

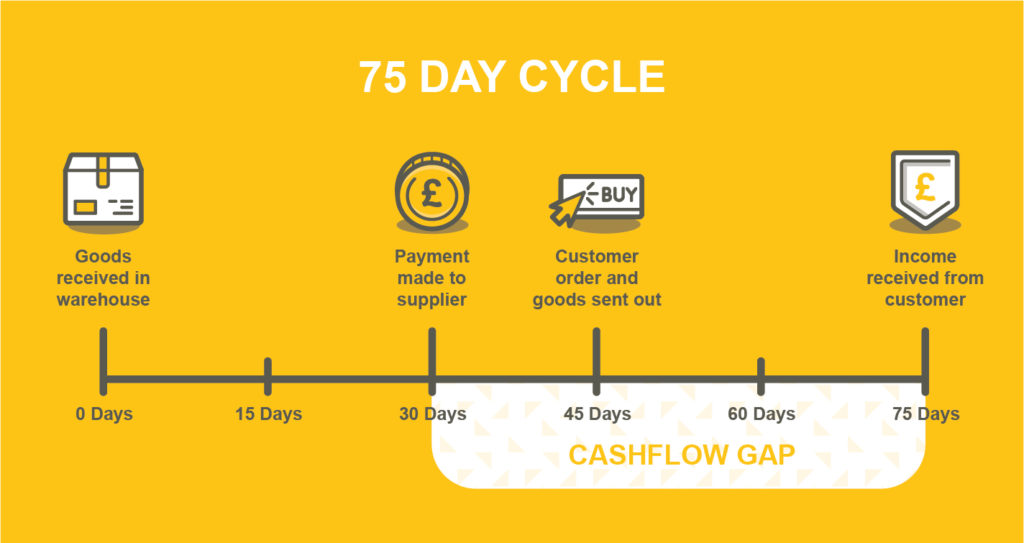

One of the purposes of the forecast, and probably the most compelling, is to close the cash-flow gap. This is a concept in finance that describes a point in time starting from the time payment is made to the supplier and ending at the time the customer pays. In other words, it is from the moment you spend money, cash outflow, to the time you receive money, cash inflow. The forecast aims to decrease the number of days of the cash-flow gap.

What is three-way forecasting?

This refers to the ability to forecast your profit, balance sheet, and cash flow, simultaneously.

Why is it crucial to make a three-way forecasting when we just finished discussing that cash flow is more important? For one thing, there are some aspects of a business that can only be affected by a perusal of other financial statements. Some balance sheet activities affect the cash flow and are not found in the Profit and Loss Statement. For example, in the balance sheet you can find the following:

- Income from Finance

- Capital purchases

- Capital repayments

- Other types of finance

- Prepayments

- Accruals

- VAT movements

These represent some form of income or expense that the company has to make. Without the more thorough analysis, such as that offered by a three-way forecasting, you could easily overlook them, causing you and your finances to get blindsided.

But it doesn’t end there. So you have taken our advice and are now implementing monthly forecasts. The next thing you should do is to track your expected and actual results. Tracking your business forecast against real-life results will help you forge a much more accurate forecast.

You will be able to understand the variances that come up and make corrections, accordingly. You can figure out why some targets are reached and others are missed. You can identify overspending and consequently make a more precise and relevant forecast.

Tips to help you create a three-way forecast

First, remember to compare your budget and actual numbers. Weigh your expected numbers against your past records and identify whether or not it looks realistic. Look at the major costs if they are complete.

Next, timely compare your budget on a per-line basis against your actual per line results. This is to ensure that you can pick up on any issue and address them expeditiously.

Also, remember to look at other expenses you won’t find in your P/L like capital purchases, loans, or capital repayments.

Over a period of time, review each line of your forecast balance sheet. If the figures are suspicious within that time span, you need to review your assumptions because they do not reflect reality.

Carefully analyze the assumptions you set up, do not use a broad and blanket approach. Most businesses are complicated and unique from one another. There is no one-size-fits-all forecast. Get advice from experts with experience in delivering customized forecast templates.

With Mehanna Advisors, we will guide you to apply just the right forecast solution for your business. You can’t create a perfect plan, but you can to try to get to the closest thing—and we can get you there.